Japan’s Economy Shrinks as U.S. Tariffs Hit Key Exports

GDP Contracts for First Time in Six Quarters

Japan’s economy shrank at an annualised rate of 1.8% in the latest quarter. This decline comes as U.S. tariffs reduced exports and housing investment fell sharply. It is the first contraction in six quarters and comes at a sensitive time for the new government.

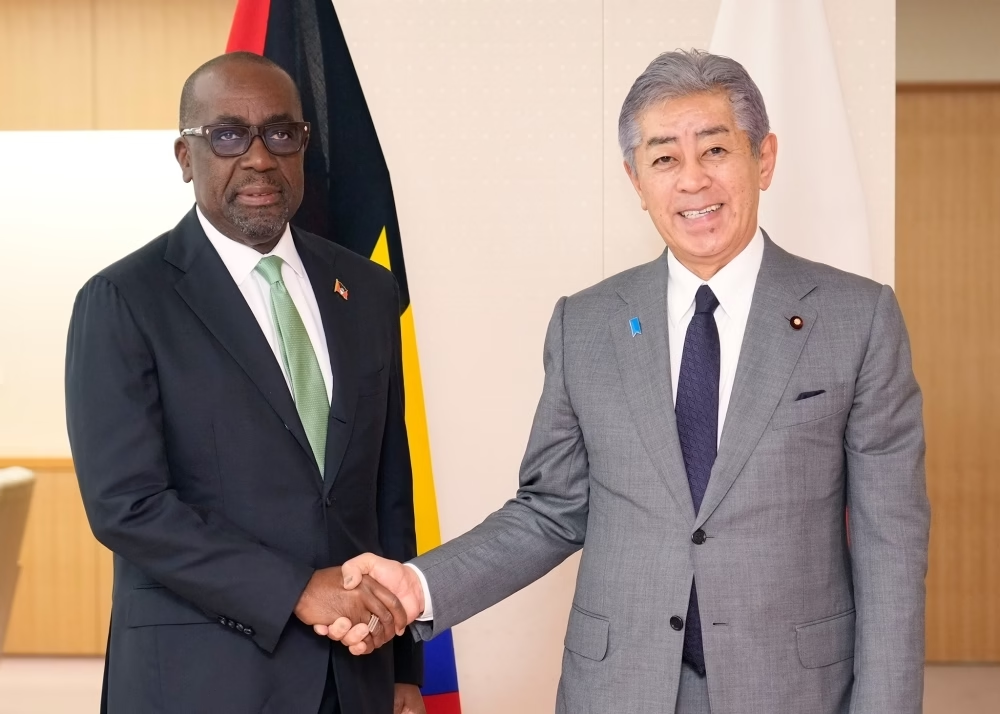

Prime Minister Sanae Takaichi took office in October. She promised support for households struggling with rising living costs. As a result, her government is expected to release a major stimulus package soon. The goal is to lift confidence and boost the slowing economy.

Exports Hit by Tariff Uncertainty

Meanwhile, weaker exports drove much of the GDP decline. U.S. tariff threats created uncertainty for companies. Consequently, industrial activity slowed, and shipments decreased. Net goods and services exports fell, pulling GDP down by 0.2%.

During the previous quarter, exports rose as firms rushed shipments before tariffs increased. However, that temporary surge made the current slowdown more noticeable.

Japan and the U.S. later reached a deal. The agreement lowered tariffs to 15% from the threatened 25%. Japan also pledged $550bn in U.S. investment. Still, export weakness remained.

Household Spending Remains Weak

Economist Stefan Angrick from Moody’s Analytics said tariffs were hurting production and exports. He added that household spending stayed weak as inflation outpaced wage growth. Pay may slow further if tariffs continue to pressure the economy. In fact, Japan has faced similar challenges for three years.

Private consumption rose only 0.1% from the previous quarter. Housing investment dropped 9.4%. In other words, high prices and uncertainty discouraged families from spending.

Government Stimulus and Policy Challenges

Analysts expect weak data to push Takaichi toward large fiscal spending. Although this could create volatility in government bonds, most agree the government will proceed.

The contraction also complicates the Bank of Japan’s next steps. The central bank meets in December to decide on interest rates. Rising inflation and strong lending had supported calls for a rate hike. However, the latest GDP data weakens that case. Many analysts now expect any increase may be delayed until 2026.

Outlook for Recovery

Overall, Japan is navigating weaker consumption, export pressures, and high living costs. Still, the government hopes its stimulus package will spark recovery. Yet, uncertainty remains about the pace of growth.

Join the Dadli News WhatsApp Group: https://chat.whatsapp.com/L04JxtMbG39FLBbxYWlz9T

Join the Dadli News WhatsApp Channel: https://whatsapp.com/channel/0029VbBcJ3gKLaHkB4lQXM1m

English

English