Hesse, Gobat Clarify Alfa Nero Brokerage Deal

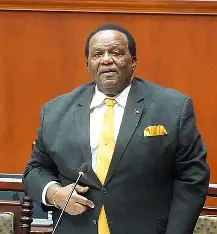

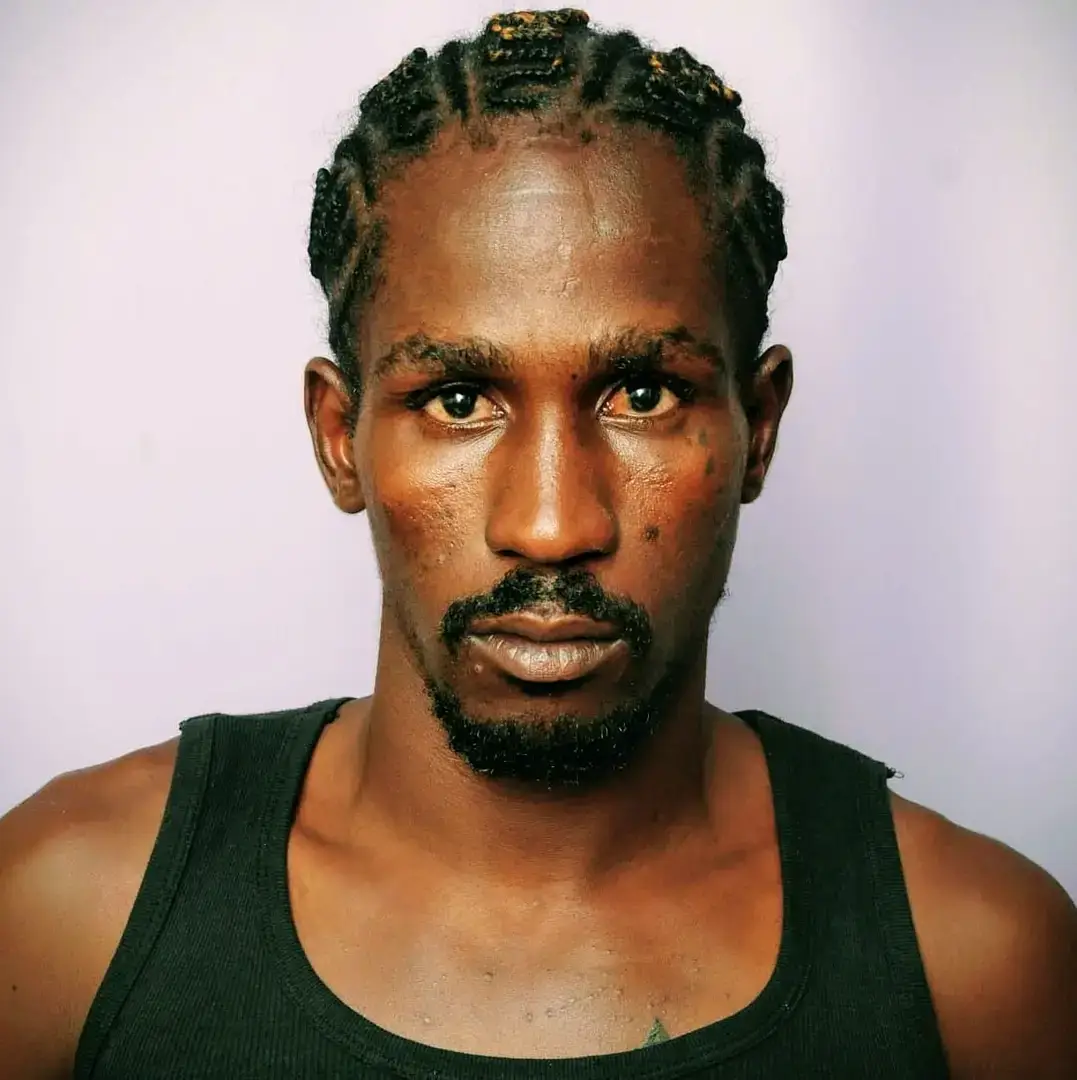

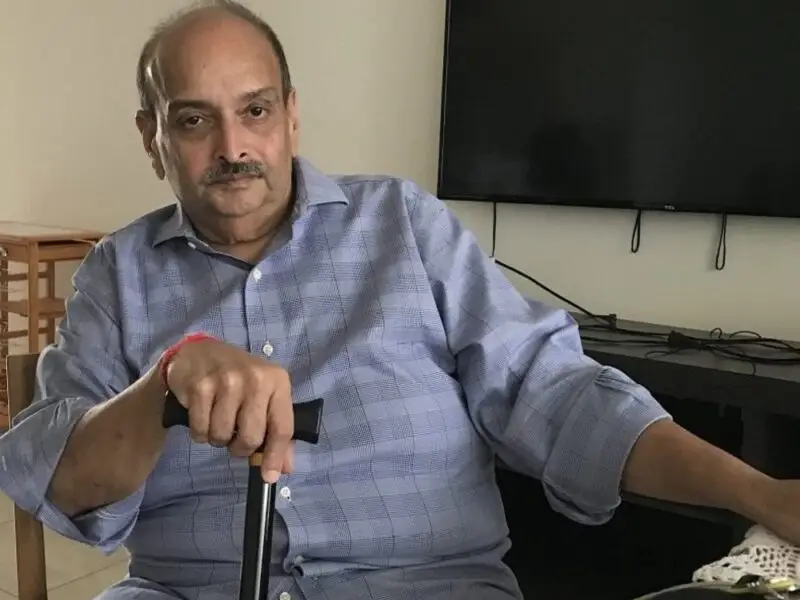

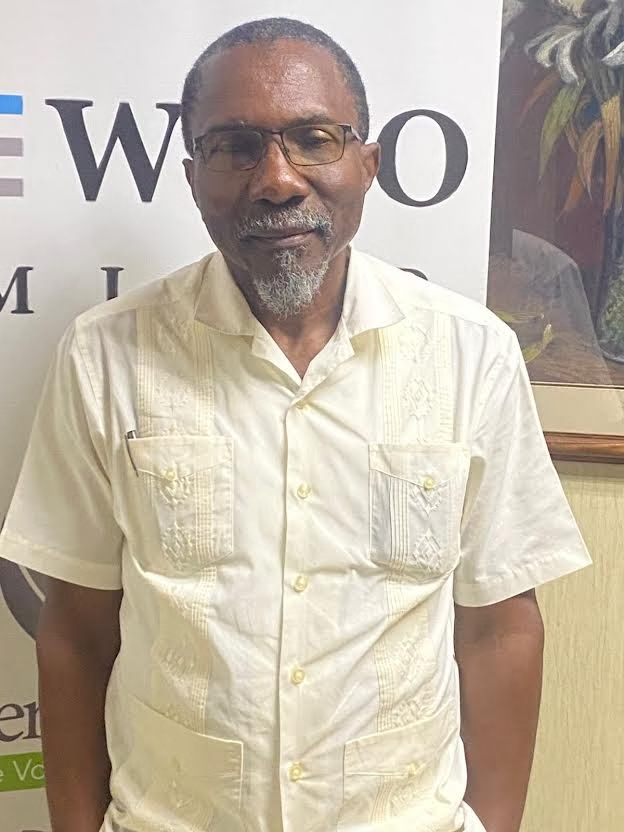

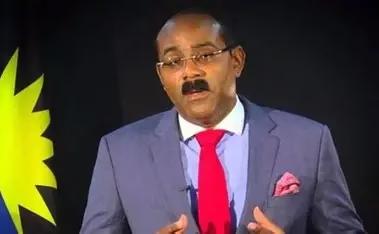

Hesse and Gobat moved to clarify public claims about the yacht ALFA NERO sale.

In a joint statement, Johann Hesse and Rufus Gobat addressed questions about brokerage payments. They focused on an introducer agreement tied to the motor yacht ALFA NERO.

First, they outlined the contract structure. A UK-registered firm, Caribbean Lifestyle Services Ltd, signed an Introducer Introductory Fee Agreement in June 2024.

The agreement was with Northrop & Johnson Monaco SAM. This followed talks with industry professionals. Earlier, a separate auction process had failed.

Under the contract, compensation had strict limits. The introducer fee would come only from the broker’s earned commission.

Moreover, payment depended on a completed sale. The buyer also had to be handled by the brokerage. If those terms were not met, no payment would follow.

Therefore, the men stressed, no separate stream of money existed. The structure tied all compensation to a successful transaction.

In addition, they said all sums were declared in the United Kingdom. They stated the company met legal, tax, and compliance duties.

They also emphasized transparency. Proper documentation, they said, guides their operations.

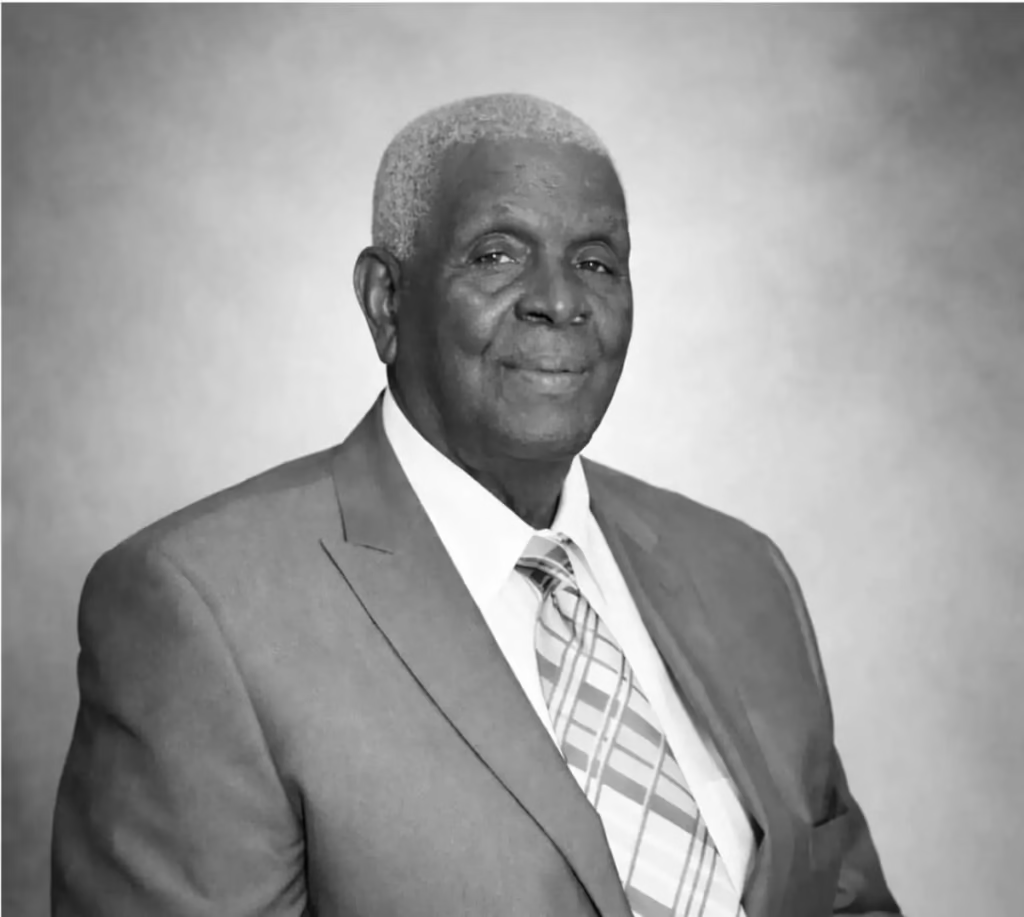

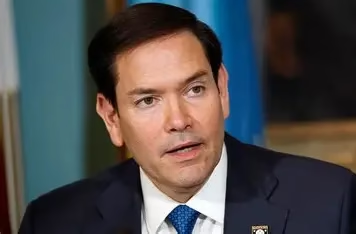

Furthermore, the statement rejected claims of improper payments. Neither man, nor the company, paid any public official.

They also denied payments to relatives of public officials. According to the statement, no funds moved directly or indirectly for that purpose.

Importantly, they described the arrangement as standard practice. Introducer agreements, they said, are common in yacht brokerage.

Such agreements often reward parties who bring qualified buyers. However, those rewards usually come from existing commissions.

They added that public figures cited in reports may cause confusion. Those amounts, they argued, formed part of the broker’s disclosed commission.

As a result, they insisted no hidden or extra commission existed. No supplemental payment stood outside the brokerage framework.

In conclusion, Hesse and Gobat said the deal reflected a straightforward commercial structure. It remained contingent on a successful sale. And it operated within established regulatory and tax rules.

English

English